Make A Will

Protecting Your Wealth

The vast majority of people put off making a Will for various reasons, either believing that the people they would wish to inherit will automatically do so or because they don't think it is relevant to them at this particular time.

The reality is that you can put off making a Will until it is too late, which poses all sorts of problems for the people left behind and could mean that some, or all of your inheritance, either goes to the wrong person or the state.

Everyone needs to make a Will. In particular, anyone with dependent relatives must do so. Anyone who owns a property or has any asset which you would wish relatives, friends or charities to benefit from should also make a Will.

Making a Will enables you to precisely plan what will happen to your property (estate) following your demise. It ensures that those you would like to benefit from the Will do so under your wishes whilst avoiding any disputes between relatives.

Frequently Asked Questions

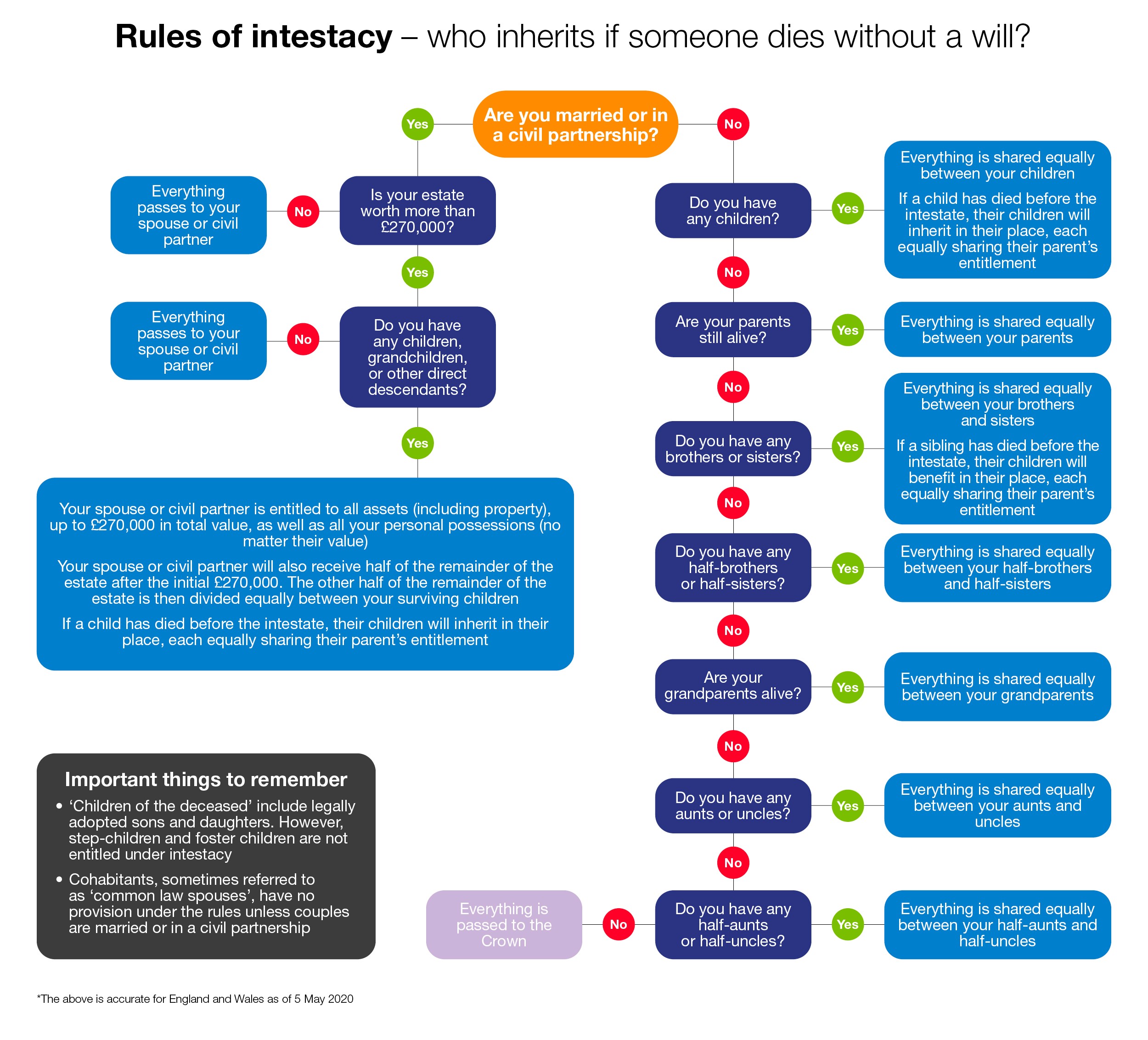

When a person dies without leaving a will, they are described as having died intestate, which means that their estate will be distributed according to the rules of intestacy.

In England and Wales, there is a statutory set of rules, that were updated in October 2014 and that are enforced if you die intestate. (The rules are different in Scotland). Your estate would be divided according to this fixed set of rules, irrespective of what your intentions actually were, and that means your estate might not be divided in the way you expect - or want!

The rules will enforce the division of your estate in a fixed order as below:

- 1. Married couples and civil partners. If you die intestate, your spouse or civil partner will only receive a certain amount of your estate (currently the first £270,000, plus half of everything above that amount). They may also inherit if you have informally separated, but not if you have divorced or legally ended your civil partnership.

If you're married or in a civil partnership and you die intestate, your spouse or civil partner will not automatically receive all of your estate. They will only receive your personal possessions, along with:

- • all of the rest of your estate if you have no children, grandchildren or great grandchildren.

- • the first £270,000 of your estate, if you have children, grandchildren or great grandchildren, plus half of the rest of the estate. The other half of the rest of the estate will go to your children.

Other considerations

- • If you have joint bank accounts, the account passes automatically by survivorship to the other joint account holder.

- • If you own land or property with another person (you're the co-owner), the way it is dealt with for inheritance depends on how you own it:

- • If you own the land or property as beneficial joint tenants when you die, your co-owner will automatically inherit your share.

- • If you own the property as tenants in common, your co-owner will not automatically inherit your share of the property but it will be dealt with by your will or by the rules of intestacy if you don't have a will.

The property and money that your partner has automatically inherited according to the joint ownership rules will not be part of the estate that is being shared according to the

-

2. Children. If you die intestate and are survived by children, birth or adopted, the rules of intestacy will divide the estate in one of two ways:

- • If you have a surviving spouse or civil partner, part of it will pass to them (the first £270k plus personal possessions) and the rest will be distributed amongst your children. If your estate is worth less than £270,000 your spouse or civil partner will inherit the whole of your estate and your children will receive nothing.

- • If you have no surviving spouse or civil partner your child or children will receive the whole of your estate.

In both of the above cases the part of the estate apportioned to your children will be shared equally amongst them.

Do remember that if you are separated but are still married or in a civil partnership, your spouse or civil partner may inherit, even though you no longer live together. This means that your children may not inherit any of your estate if you die intestate.

Children from another relationship and adopted children

When an estate is being divided under the rules of intestacy, all of your children are treated equally. Children from all relationships and legally adopted children will receive equal shares of your estate.

Step-children will receive nothing if there is no will providing for them, regardless of your relationship or how long you cared for them, unless you have legally adopted them.

When will my children receive their inheritance?

Under the rules of intestacy, your children will only receive their inheritance when they either:

- • reach the age of 18; or

- • marry or enter into a civil partnership before they become 18.

- 3. Grandchildren/great-grandchildren. If you die intestate, your grandchildren and great grandchildren will not inherit any of your estate unless one of the following criteria is met:

- • The child's parent or grandparent died before you.

- • The child's parent is alive when you die, but dies before reaching the age of 18 and is not married or in a civil partnership.If either of the cases above, the grandchildren and great grandchildren will inherit an equal share of the amount their parent/grandparent would have received.

In either of the cases above, the grandchildren and great grandchildren will inherit an equal share of the amount their parent/grandparent would have received.

- 4. Other relatives. Under the rules of intestacy relatives such as parents, siblings, uncles and aunties might inherit some of your estate where certain circumstances are met.

If you die intestate leaving no surviving spouse or civil partner, your estate will be distributed in a strict order, which is:

- • If you have children, they will inherit all of your estate in equal shares. If a child has already died, his or her children will inherit their share of the estate.

- • If there are no children, your surviving parents will inherit your estate in equal shares.

- • If there are none of the above, your brothers and sisters will inherit in equal shares. If a brother or sister has already died, their children (your nieces and nephews) will inherit their share of the estate.

- • If there are none of the above, your half-brothers and half-sisters will inherit your estate. If a half-brother or half-sister has died, their children will inherit their share of the estate.

- • If there are none of the above, your grandparents will inherit your estate in equal shares.

- • If there are none of the above, your aunties and uncles will inherit your estate. If an auntie or uncle has already died, their children (your cousins) will receive their share of the estate.

- • If there are none of the above, your half-aunties and half-uncles will inherit your estate. If a half-auntie or half-uncle has already died, their children will inherit their share of the estate.

- If you have no surviving blood relatives, your estate is passed to the Crown.

Put simply, without a legal will in place, your estate may not be distributed in a way would want when you die, and those people you want to look after might be left without any inheritance.

Why do you need a Will?

- Everyone should have a Will, but 2 out of 3 people have not yet made one, and those who have may not have the correct one in place.

- An estimated 70,000 people per year have to sell their homes to pay for care.

- A large proportion of any inheritance may be lost in future divorce settlements, creditors, or in bankruptcy and unnecessary taxation.

- If you own a business or shares in a company, your spouse/partner and children may not inherit your share of a business.